If you want to stand out as a licensed tax professional, it will help to know which credentials to consider. You top two choices should be either a Certified Public Accountant (CPA) or an Enrolled Agent (EA). So, what’s the difference between a CPA vs EA?

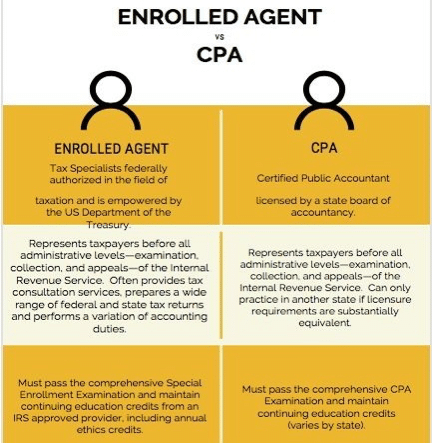

Both the EA and the CPA credentials come with a strict code of ethics and professional standards. However, the EA license is regulated at the federal level while the CPA is at the state level.

Being licensed at the state level, though means that the scope of work is limited to those jurisdictions. An Enrolled Agent and a CPA are both tax experts and the work done is somewhat similar but there are several areas of differences too.

This post will take you through the various details of the CPA vs EA difference, EA vs CPA salary, Enrolled Agent vs CPA exam difficulty, EA vs CPA for taxes, and more.

Contents

- 1 What is Enrolled Agent vs CPA

- 2 CPA vs EA Difference – A Broad Look

- 3 Differences Between CPA & Enrolled Agent

- 4 Enrolled Agent Exam vs CPA exam

- 5 EA vs CPA Exam

- 6 EA vs CPA – Exam costs

- 7 Tax Enrolled Agent vs CPA for Business Taxes

- 8 EA vs CPA

- 9 Cost of Each License

- 10 CPA vs EA License?

- 11 Tax Preparer CPA vs Enrolled Agent – FAQ

- 12 Summing Up

What is Enrolled Agent vs CPA

Let’s start by comparing and contrasting the work responsibilities of each credential.

EA

EAs are federally authorized tax practitioners who represent taxpayers before the IRS on a range of matters such as collections to IRS audits and appeals.

EAs also provide tax advice and file returns for individuals, corporations, partnerships, trusts, estates, and any other entities that have to report taxes.

CPA

A CPA is a state-licensed accounting professional who may be an accountant, auditor, business advisor, tax consultant, financial planner, forensic accountant, and corporate accountant and executive.

Hence, in a CPA vs Enrolled Agent comparison, both are experienced and knowledgeable professionals. The primary difference is that EAs specialize in taxes while CPAs can specialize in taxation and a whole lot more.

CPA vs EA Difference – A Broad Look

A detailed perspective of the main differences between CPA and EA

Differences Between CPA & Enrolled Agent

| Criteria | CPA | EA |

|---|---|---|

| Professional Focus | Board accounting, tax and financial services for businesses | Taxes for businesses and individuals |

| Qualifications for Practice | State education requirements (usually 150 hours of undergrad) pass CPA exam | Five years IRS experience; pass the EA exam |

| Hourly Rate | Average of $30 to $500 depending on experience, rank within firm, whether CPA is a firm owner | Average of $12 to $55 |

An analysis of the table above shows for IRS Enrolled Agent vs CPA, the qualifications required for practicing Accountant EA vs CPA are quite different as is IRS Enrolled Agent vs CPA salary, both of which will be seen in detail in this post.

EA vs CPA salary

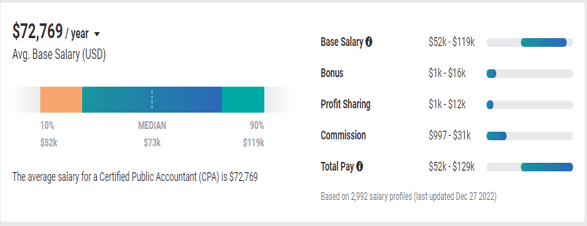

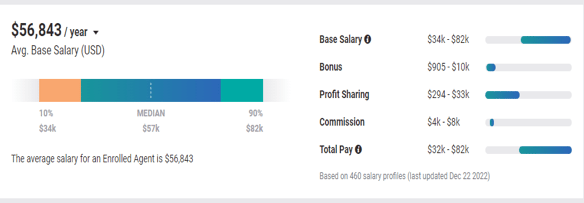

The Enrolled Agent vs CPA salary both at the start of the career as well as the top end is vastly dissimilar.

The salary range for a CPA is $52k to $119k including base salary, bonus, profit sharing, and commission. The average salary hovers around $73k. On the other hand, the range for an Enrolled Agent starts from $32k and goes up to $82k. This includes base salary, bonus, profit sharing, and commission. The median salary is about $57k.

Hence, the CPA has a clear edge when the CPA vs EA salary is considered.

Enrolled Agent Exam vs CPA exam

The paths to a CPA and EA are quite similar. However, the way that the requirements must be fulfilled are quite different.

| EA Exam | CPA Exam |

| Item | Fee | Item | Fee |

|---|---|---|---|

| Testing Fee (per part) x3 | $203 | Examination Fee (per part) x4 | $208.40 |

| Average EA Review Course | $500 | Application Fee | $100 |

| Enrollment for Practice: | $67 | Average CPA course | $1,700 |

| Ethics Exam | $130 | ||

| Licensing Fee | $150 | ||

| Total | $1,257.00 | Total | $2,913.40 |

EA vs CPA Exam

Enrolled Agent Exam

To qualify as an Enrolled Agent, you must take the Special Enrolment Exam (SEE) or have previous experience working at the IRS.

Once you have several years of experience in taxation, it’s much easier to pass the exam.

There are no preconditions to appear for the exam and you can do so as soon as you obtain a Personal Tax Identification Number (PTIN), even if you’re still in college.

The EA exam has three parts and there is no time limit between taking each exam which lasts for an hour each, making for a total of 4 hours.

Certified Public Accountant Exam

For the CPA exam, there is an education requirement to be met.

Every state board of accountancy mandates 150 credit hours of education to sit for the CPA exam. Many boards require these credit hours to be in accountancy.

The CPA exam has four parts and overall, it’s much broader in scope than the EA exam.

You have to pass the CPA exam within a rolling period of 18 months, starting from the time you pass the first part.

Enrolled Agent vs CPA Exam Difficulty

According to the people who have taken both the EA and CPA exam, the CPA is more difficult to pass. This is primarily because of the extent of studies required for each exam and the topics covered.

The EAs are experts in taxation and hence the SEE deals in-depth with tax topics.

On the other hand, for the CPA exam, four different subfields of accountancy have to be covered and hence more study materials have to be absorbed by the candidates.

Enrolled Agent vs CPA

What is an EA vs CPA When comparing the roles of CPA vs EA, it’s seen that the scope and responsibilities of the CPA are much wider in scope.

Not only that, a CPA has a much better chance of fast-tracking career possibilities to the CFO level.

This is because the responsibilities of an EA are restricted to taxation only whereas a CFO must have great knowledge of the various aspects of accounting and finance, aspects that are right up the street for a CPA.

| Section | CPA | EA |

|---|---|---|

| Role | Accountant, Financial Advisor, Tax Specialist, Consultant, CFO, Auditor, Controller, etc. | Tax specialists who represent their clients before the IRS. |

| Licensing | Different states have a professional body that handles licensing. | The federal government, IRS. |

| Examination | To be a professional, you must pass the four parts of the CPA exam. | To be an EA, you must pass the three parts of the Special Enrollment Examination (SEE).

OR If you have worked with the IRS formally, hold technical expertise related to taxation and have ensured ethical conduct, you can become an EA. |

EA vs CPA – Exam costs

Another factor to take into account for EA vs CPA is the cost of taking the exam. That of the CPA is higher than the EA simply because it has more parts.

Typically, if you pass each section on the first attempt, costs come to $833.60. But you have to pay retake fees if you fail in any part. Then there are the Review courses, starting at $1,700 which are essential to crack the CPA exam on the first attempt.

If all the costs are taken into account for CPA vs EA, for CPA it comes to around $3,000 while for EA it’s about $1,300.

Tax Enrolled Agent vs CPA for Business Taxes

EA vs CPA for taxes

For business taxes, which accounting professional should you choose?

There are a couple of very strong reasons for hiring an EA.

First is the experience. An EA has first-hand knowledge of working with the IRS and this can be a huge plus point.

Second, EAs work in a specialist niche of taxation and can be depended upon to prepare your tax return, the prior year’s unfiled returns, and make sure that your business taxes are in order. You will know that you’re getting value for money as EAs specialize in taxes.

On the other hand, CPAs are a great help to business owners as they have the required expertise in all things that are related to finance including reviewed and audited financial statements and bookkeeping.

All these are very important for calculating tax payable and preparing returns which a CPA is also very adept at.

Tax EA vs CPA

Given all these variables, which among Tax EA vs CPA should you hire?

A CPA would be very useful for business tax preparation for medium and large-scale organizations as they offer a wide range of services that ultimately lead to taxation though at much higher fees than EAs.

EA vs CPA

Cost of Each License

If you think about what is an EA vs CPA, one of the main points of difference is the cost to get the license and set up practice.

The cost of a CPA license is $150 and this does not include the expenses of passing the exam such as the application fee and cost of study materials which can be as high as $1,700. Overall, it can touch $3k, excluding what it costs to complete the required continuing education of 120 hours over 3 years.

To become an EA, a PTIN from the IRS would cost $50 along with an enrolment fee of $30. The cost of taking each section of the exam is $111.95 and there are three of them. The continuing education for Enrolled agents as per IRS requirements is 72 hours every 3 years.

Comparing IRS Enrolled Agent vs CPA cost of a license, CPA is much higher.

CPA vs EA: What does Reddit Have to Say?

Here are some of the responses on Reddit for various sides of CPA vs Enrolled Agent

IRS Enrolled Agent vs CPA Advantages

The only advantage an EA has over a CPA is that EA is a federally recognized certification so you could set up your practice anywhere without having to deal with state regulations.

With CPA you have to contact the state boards of accountancy anytime you move to validate your license before practicing. I’ve been told it’s rarely an issue to get a reciprocal license other than you might have to take a different ethics exam.

EA vs CPA Exam Difficulty

I’ve passed both exams and the CPA exams were way harder, even after a Master’s in Taxation.

For the CPA exams, I studied ~100 hours for each exam in a 4-6 week timeline. It was tough, but it’s doable.

What is an Enrolled Agent vs CPA – FAQs

EA vs CPA – Work Responsibilities?

- An EA is an IRS-authorized tax professional and is especially skilled in all aspects of taxation.

- A CPA, apart from preparing and filing tax returns, can also perform audits and offer wealth-related financial advice.

CPA vs EA License?

EA – Federal Government, IRS / CPA – Given by professional bodies of different states in the US.

CPA vs Enrolled Agent Exam?

- EA – The score of each test section is valid for 2 years The passing score for each section is scaled to 105.

- CPA – All 4 parts have to be passed in 18 months. The pass mark for each section is 75.

EA vs CPA salary?

- EA – $40k to $65k depending upon experience

- CPA – About $66k with 1 year experience

Tax Preparer CPA vs Enrolled Agent – FAQ

CPA vs Enrolled Agent – Choose whom for tax preparation?

- CPA – Broad accounting, tax, and financial services for businesses,

- EA – taxes for individuals and businesses

Summing Up

Hopefully, this post should have helped you get to the root of the various CPA vs EA issues. Go for EA if your passion is taxation and representing clients before the IRS to resolve issues. On the other hand, as a CPA, you’ll have a broader outlook on the various aspects of the accounting and finance field.

Both types of professionals are qualified to perform similar tasks. However, it ultimately comes down to the range of services each credential can perform where they differ.