NASBA officially moved to a Continuous Testing approach for the CPA Exam on July 1, 2020.

Continuous Testing was in the works for a while. Despite all of the chaos and disruption caused by COVID-19 / Coronavirus over the past year, NASBA finally decided to move forward and implement the more flexible testing approach. This has been a huge benefit to CPA Exam candidates everywhere, and gives you a lot more flexibility in scheduling and passing the exam.

Let’s take a look at some of the key changes that Continuous Testing has brought:

Contents

What is Continuous Testing?

With Continuous Testing, CPA Exam candidates are now able to sit for the CPA Exam year-round without any scheduling restrictions.

That’s right, gone are the days when you had to schedule your exams months ahead of time and hope for the best! Under the old model, candidates were only allowed to sit for the exam during the first ~10 weeks of each calendar quarter, making it practically impossible for anyone working as an accountant to study and sit for the exam during Q1, an entire quarter of the year!

Continuous Testing allows candidates to pass the CPA Exam faster and reduce the risk of losing credit on previously passed exam sections. With Continuous Testing, candidates who fail an exam section can now reschedule that exam as soon as possible once they receive a new NTS, instead of waiting until the next testing window.

Which states offer Continuous Testing?

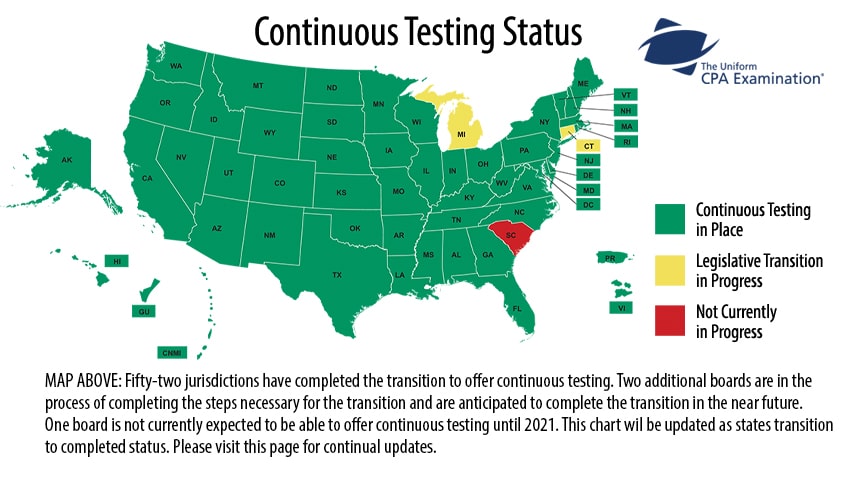

As of now, fifty-two U.S. jurisdictions have cleared the way and another 3 are expected to pass legislation to allow for Continuous Testing starting July 1, 2020. This includes Washington D.C., Puerto Rico, the U.S. Virgin Islands, Guam, and the Mariana Islands.

As of now, the only state / jurisdiction that did not meet the July 1, 2020 deadline was the state of South Carolina, which is scheduled to update their charter to offer Continuous Testing sometime in 2021. Until then, South Carolina candidates can take the exam anytime, they just cannot retake a failed section until the next calendar quarter.

That means every U.S. state and territory, including:

What will happen to existing NTS Windows?

In response to the Coronavirus outbreak NASBA has been extending NTS windows on a state-by-state basis. The guidance is frequently changing so I recommend you follow NASBA’s NTS extensions page for the latest updates.

What has stayed the same under Continuous Testing?

The CPA Exam Sections

The CPA exam still consists of four distinct sections:

- Audit & Attestation (AUD)

- Business Environment and Concepts (BEC)

- Financial Accounting and Reporting (FAR), and

- Regulation (REG)

Each exam section still features a combination of multiple-choice questions and task-based simulations. The BEC exam also includes a written communication section. While each section features a slightly different mix and blueprint, each exam still requires a score of at least 75% in order to pass.

As always, you must pass all four sections of the exam within an 18 month rolling window in order to completely “pass” the CPA exam.

18-Month Rolling Window

Starting with the first section that you pass, you still only have 18 months to successfully pass the remaining three sections of the exam.

If you don’t meet the 18 month deadline then the first exam you passed will officially lapse and your 18 month window will shift and now start with the second exam you passed. You’ll then have to retake (and pass!) that first exam section within the new 18 month window.

18 months may seem like a reeealllly long time, but it can actually go by very quickly. This is especially true if you’re juggling lots of other commitments and work a full-time job in public accounting.

Don’t let one of your exam scores expire!

I know quite a few people who had to retake sections of the exam because they didn’t prioritize things correctly and let life get in the way. It was painful to watch!

That being said, you also shouldn’t try to cram all four sections into a 2-3 month window. The AICPA gives you an 18-month window for a reason, so don’t be afraid to use some of it! I recommend you aim to take no more than two exams in any given 3 month window.

How to Prepare for the CPA Exam

As always, it will be important to develop and stick to a consistent study schedule to make sure you’re prepared come exam day. Whatever exam timeline and schedule you come up with, make sure it’s realistic and aligns with your overall strategy. Likewise, it’s still critical to get yourself a top-level CPA review course that plays to your strengths and aligns with your learning style.

If you plan things properly and stick to a consistent study schedule with a review course that works, anything is possible, including you becoming a CPA! Best of luck on the exams, and be sure to check out more content here to help you on your CPA journey!