Why Should You Get Your CMA?

The Certified Management Accountant (CMA) designation gives you a leg up when finding your first accounting job. By becoming a CMA, you’ll be able to build on your existing skills, broaden your horizons and maximize your earning potential.

However, there are many other benefits as well. Let’s walk you through 8 reasons why CMA Accountant(s) are important.

1. Credibility

In today’s business world, credibility is the foundation on which career success is built.

As a CMA, you’ll uphold the highest professional and ethical standards in the business world. Hence, you’ll be trusted by clients, employers, and colleagues alike.

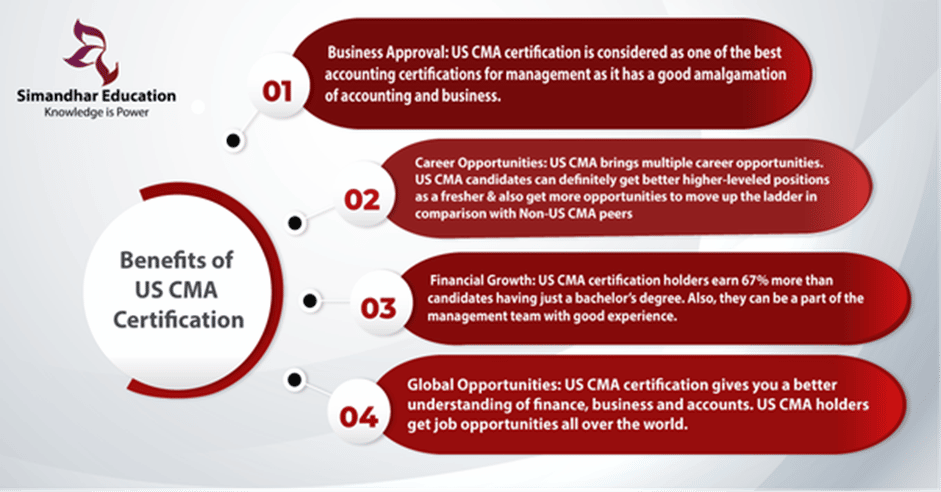

2. Opportunities

Many opportunities are available for those who become certified management accountants. As a CMA you can work in corporate accounting, government, or even become a consultant.

The CMA designation is widely recognized internationally. If you have any interest in working outside of the U.S., this certification will help you stand out in the job market.

3. Income potential

Earning your CMA credential can provide a significant boost to your career and earnings potential.

According to IMA’s 2021 Global Salary Survey, the median annual salary for accountants, auditors, and financial analysts was $103,000 in America and $60,000 across all countries. This number will only go up over time.

4. Job satisfaction

Many people work primarily for money, with job satisfaction being an afterthought. CMAs don’t always have to make this trade-off.

In fact, job satisfaction for CMAs tends to be higher as CMAs work in more dynamic roles and have greater responsibilities than their non-CMA peers.

It won’t be all unicorns and rainbows, and all jobs have their downsides. However, earning your CMA is sure to make you eligible for more rewarding projects and roles during your career.

5. Career Growth

A CMA has the potential for significant career growth. Certified Management Accountants are in high demand by employers, and the credential can lead to promotions and higher salaries.

Increasingly, the CMA designation is seen as a comparable alternative to a CPA license. This trend is expected to continue as the war for talent in accounting and finance rages on.

The CMA designation will enable you to move into different roles within your organization or even change careers altogether. And since the CMA is recognized internationally, there are CMA job opportunities worldwide.

6. Networking opportunities

As a CMA, you’ll have access to several networking opportunities. You’ll be able to connect with other CMA Accountants, which can lead to potential CMA job opportunities or business partnerships.

You can also attend conferences and events specifically for CMA candidates that will help you stay up-to-date on industry trends and learn new skills.

7. Personal development

The CMA credential can help you develop both personally and professionally. It’s well-respected among employers and can advance your career, thereby giving you a sense of pride and accomplishment.

The CMA exam is also one of the toughest exams in accounting, so once you pass, it’s a sign that you have truly mastered all aspects of accounting and finance.

8. CMAs have access to exclusive resources through the Institute of Management Accountants (IMA)

The IMA is the world’s largest association for management accountants. As a CMA, you’ll have access to a wealth of resources and support from an elite group of certified professionals.

Ready to Become a CMA?

As you can see, there are many perks to becoming a certified management accountant. From achieving a better work-life balance to bolstering career growth and making more money, getting your CMA license can pay major dividends for your accounting career.

Want to learn more about the CMA exam? Head on over to our CMA exam hub for more articles.

Ready to start studying for the CMA exam? Read our reviews of the best CMA review courses and find one that fits your needs. Regardless of your learning style or budget, there are plenty of options to help you succeed on the exam and level up your accounting career today!