Thinking about earning your CFA or CPA license? Both are great credentials to consider, but there are some key differences between the work responsibilities, exam process, salary expectations, and career paths each certification will offer. There are also some key differences between the CFA and CPA exams and there’s healthy a debate around the topic of CFA vs CPA exam difficulty you should consider.

This post will address what the CFA and CPA are all about, starting with a detailed look at each credential right down to which one is better for a CFO-track, CFA vs CPA.

So, let’s dive straight in.

Contents

- 1 What is a CFA?

- 2 What is a CPA?

- 3 CFA vs CPA: Comparing Each Certification

- 3.1 What type of work does a CFA vs CPA do?

- 3.2 CFA vs CPA Career Paths

- 3.3 CFA vs CPA for A CFO Track: Which is Better?

- 3.4 CFA vs CPA Salary Comparison

- 3.5 CFA and CPA Combination Salary

- 3.6 Benefits of Being a CFA vs CPA

- 3.7 CFA Exam vs CPA Exam

- 3.8 CFA vs CPA Exam Difficulty

- 3.9 CFA vs CPA Hours

- 3.10 CFA and CPA Exam Pass Rates Compared

- 3.11 What does Reddit Have to Say?

- 4 CFA vs CPA – Which is Better for You?

- 5 Bottom Line

What is a CFA?

CFA stands for Chartered Financial Analyst and is a professional designation awarded by the CFA Institute. To earn the CFA credential, finance professionals must demonstrate both expertise in wealth management and investment analysis. They must also be skilled in portfolio management, investment consulting, financial research, and risk analysis and management.

CFA career paths can lead to becoming the chief investment officer at a public company or investment firm carrying out corporate finance and buy-side investment analysis. Alternately, CFAs are also highly qualified to conduct financial planning for high-net-worth individuals. The CFA is considered the highest and most prestigious certification for professional growth in financial and investment management.

What is a CPA?

Certified Public Accountants (CPAs) are primarily accountants. However, not all accountants are CPAs. The CPA designation can be earned after you pass the rigorous CPA exam and demonstrate a deep knowledge of accounting practices. CPAs must possess great integrity and are involved in accounting activities that accurately reflect the business dealings of the companies and individuals they work with.

The core duties of a CPA include examining financial records, calculating tax returns, preparing financial documents, conducting forensic examinations, advising clients on financial decisions, and managing financial information. Having analytical skills and a broad overview of business knowledge is essential for CPAs.

CPAs career paths can vary, but can lead to management or executive roles such as or accounting manager, controller, and CFO.

CFA vs CPA: Comparing Each Certification

There are several key differences between the CFA and CPA credentials, let’s have a look:

| CPA vs. CFA Comparison | CPA | CFA |

|---|---|---|

| Organizing Body | American Institute of Certified Public Accountants (AICPA) | CFA Institute |

| Exam Format | 4 individual parts, taken in any order | 3 levels, taken sequentially |

| Timeframe | ~ 0.5 – 2 years | 3 – 4 years |

| Topics | –Audit –Business Environment and Concepts –Financial Accounting & Reporting –Regulation | -Accounting -Financial Analysis -Financial Principles -Portfolio Management |

The CPA exam is conducted by the American Institute of Certified Public Accountants (AICPA). The CFA Institute awards the CFA credential.

The CPA exam syllabus comprises Regulation, Audit and Attestation, Business Environment and Concepts, and Financial Accounting and Reporting.

The CFA focuses on Financial Principles, Portfolio Management, Financial Analysis, and Accounting.

What type of work does a CFA vs CPA do?

While most CPAs specialize, most have the same general focus: to analyze financial activity and transactions in order to properly classify them in tax returns, financial statements, and other financial reports. CPAs perform tax planning and filings, provide audit and assurance services, bookkeeping, business management and consultation, and forensic accounting.

CFAs make forward-looking investment decisions, including portfolio and asset allocation, securities analysis, and business valuations. They can also assist with investment advice related to estate planning, retirement planning, education planning, and debt management.

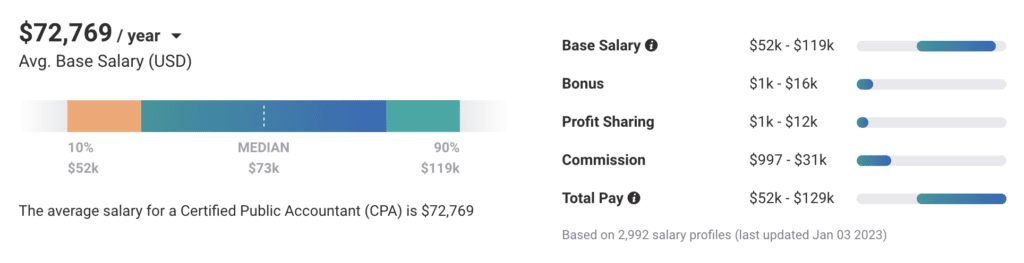

Comparing the CFA exam vs CPA exam, the CFA exam is divided into 3 levels that must be completed in sequential order. The typical path to earning the CFA takes 3-4 years from start to finish.

Conversely, the CPA exam consists of 4 distinct exam sections that may be completed in any order. Most candidates pass all 4 sections of the CPA exam within 0.5-2 years.

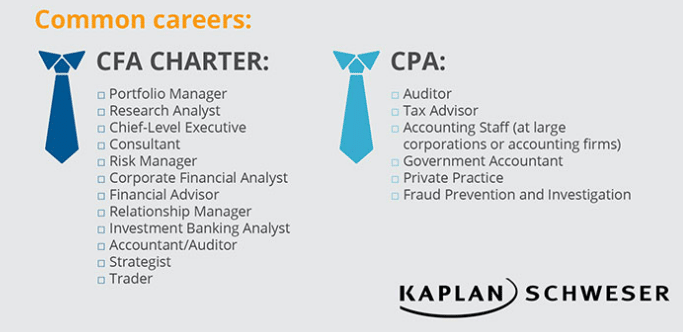

CFA vs CPA Career Paths

The career paths of a CFA vs CPA are very different. The CFA skillset revolves around investment analysis and portfolio management. Therefore, they’re mostly suited to work as financial analysts, investment strategists, consultants, and wealth managers.

A CPA’s skillset, on the other hand, is to analyze and properly classify and report financial results. CPAs often work as corporate accountants, auditors, tax preparers and reviewers, financial controllers, consultants, and even CFOs.

CFAs are mainly employed in the investment management and advisory sectors whereas CPAs are mostly employed in either corporate accounting departments or public accounting firms.

CFA vs CPA for A CFO Track: Which is Better?

The CFO’s job is to understand the financial condition of the company and drive resource allocation decisions. In the old days, most CFOs either held the CPA designation or came from an accounting background. Today, only 44% of CFOs are CPAs.

While the CFA credential certifies your ability to perform investment analysis and portfolio management, the CFA designation is mostly designed to support those working in investment banking, consulting, private equity or venture capital.

CFOs may employ CFAs to analyze investment options, but they won’t be buried in the details. Having a CFA probably won’t hurt your chances of becoming a CFO, but it doesn’t offer a clear advantage over the CPA either.

On the other hand, all CFOs must have a solid enough understanding of GAAP, financial reporting, taxation and compliance in order to successfully manage the finance function. These are all areas that CPAs are uniquely qualified for.

While there’s no set path to become a CFO, when it comes to the CFA vs CPA debate the CPA still reigns supreme. If you want to fast-track your way to becoming a CFO, start with becoming a CPA first.

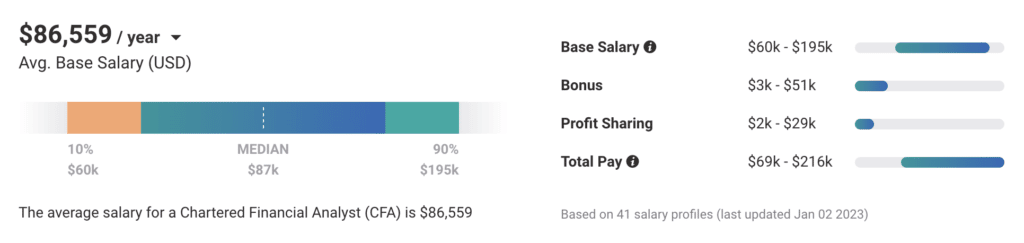

CFA vs CPA Salary Comparison

Let’s have a look at how the salaries of CFAs vs CPAs compare:

CFA and CPA salary analysis

The average median salary for a CFA is $85k with the lower 10% earning around $59k and the top bracket at $154k, which does not include bonus and profit sharing. The median salary for a CPA is $73k with the top and lower 10% earning $52k and $119k, respectively. Again, this does not include bonuses, profit sharing, and commissions.

Hence, when it comes to CFA vs CPA salary potential, CFAs earn more on average.

CFA and CPA Combination Salary

If CFA and CPA salaries are so good, could you get a salary boost by holding the CPA and CFA? Probably not.

While there are plenty of overlapping roles in the world of accounting and finance, there really aren’t many jobs that require holding both licenses at the same time. With the war on talent, it’s simply more practical for companies to find and hire CFAs and CPAs separately rather than create roles that only someone holding both a CFA and CPA can perform.

What salary can you earn with a CFA and CPA combo?

The main reason why some folks hold both licenses is because they wanted to transition their career from accounting to finance or vis-versa. At that point, your salary will be dictated by your primary job function and experience level.

In firms where one person has dual responsibilities, someone with a CFA and CPA combo will likely have a salary that’s somewhere in between what both roles would pay on their own.

Benefits of Being a CFA vs CPA

It’s hard to quantify benefits of the CFA vs CPA. Each one caters to separate professions within the world of accounting and finance and have very different career paths. While a CFA must have a thorough knowledge of investment analysis and portfolio management, a CPA concentrates on accounting, financial reporting, taxes, audits and more.

That being said, let’s look at some of the raw numbers:

- CFA-vs- CPA Salary: CFAs have a higher median salary than CPAs.

- CFA vs CPA exam difficulty: By most measures, the CFA exam takes longer to pass and is more difficult than the CPA exam.

- CFA vs CPA pass rate: The CPA pass rate and ratio is higher than the CFA.

Considering the above factors, it’s easy to see that the CFA will require a greater commitment and level of effort than the CPA, and likely lead to a higher salary. However, that means the CPA is more attainable and offers a faster path to career ROI.

CFA Exam vs CPA Exam

The main difference between the CFA exam vs CPA exam is the curriculum and the depth and scope of material each exam covers.

The CFA exam puts more emphasis on investment management, valuation, and decision-making, while the CPA exam is centered around auditing, financial accounting, tax rules, and general business concepts.

Both exams both cover a wide range of financial topics, but the CFA tests financial and investment topics at a much greater depth than the CPA exam.

The CFA exam’s core curriculum is centered around investment analysis and portfolio management, and candidates’ knowledge on these topics are tested at all three levels with progressive difficulty. Conversely, the CPA exam is broken up into four independent sections, each of which tests a distinct group of topics.

CFA vs CPA Exam Difficulty

Now let’s compare the difficulty of the CFA vs CPA exam and the heated debate about which is harder, the CFA vs CPA.

The CFA pass rates and CPA pass rates are quite comparable. However, the CFA is considered much more difficult than the CPA exam for the following reasons.

- CFA exams require up to 3x more study time than CPA exams

- CFA exams require learning newer and more challenging concepts than what you may ordinarily see in the workplace

- The CPA exam covers a wider range and scope of topics than the CFA, however the CFA goes into much greater depth and nuance on the topics it does cover.

- The CFA exam curriculum centers around financial analysis, which generally comes down to logical reasoning and math. On the other hand, much of the content on the CPA exam is rooted in accounting and tax rules that are inherently more subjective.

- The CPA exam does not require knowledge from previous exam sections. The CFA exam does.

As you can see, each exam poses its own challenges. However, general consensus on the topic of CFA vs CPA exam difficulty is that theCFA is more challenging.

CFA vs CPA Hours

The CPA exam takes 300-400 total hours of study time spread out over 1-2 years.

By contrast, each level of the CFA exam takes 300-400 hours of study time. That’s roughly 900-1,200 hours of total study time spread over 3-4 years!

The CPA exam takes a huge time commitment, but there’s no comparing against the CFA exam. In this case, the CFA exam clearly takes more time.

CFA and CPA Exam Pass Rates Compared

We compared the CFA vs CPA exam difficulty earlier, but what about the CFA vs CPA pass rate?

The CPA exam pass rates historically average between 50 – 60% percent while the CFA exam pass rates range between 40 – 50%. However, there’s a big difference between what those statistics reflect.

Since the CPA exam is tested in 4 distinct parts, the pass rates for each section are independent from each other. Conversely, candidates cannot sit for Level 3 of the CFA exam unless they’ve already passed Levels 1 and 2, yet Level 3 still has a high failure rate.

Pass ratio is actually a more accurate comparison than the CFA vs CPA pass rate. There aren’t clear side-by-side comparisons available, but only about 24% of people registering for the CFA Program end up passing Level 3. Conversely, the pass ratio for the CPA exam is CPA is estimated to be 62%. This could imply that becoming a CFA is two to three times more difficult than becoming a CPA.

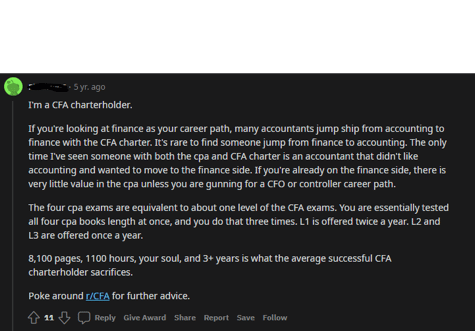

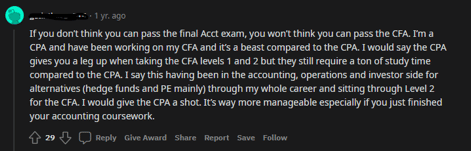

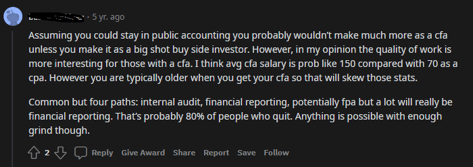

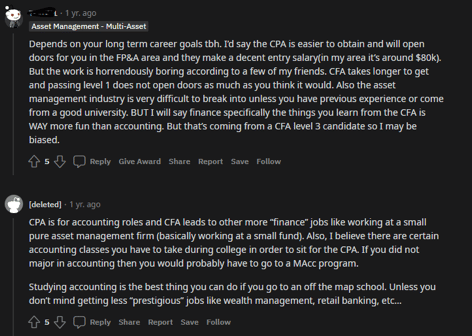

What does Reddit Have to Say?

What does Reddit have to say about the CFA vs CPA?

We’ve curated some of the best and most straightforward advice on the topics of CPA vs CFA exam difficulty, CFA vs CPA hours of study, and CFA vs CPA salary differences, which is better for the CFO route, and more.

What is the general opinion about CFA vs CPA on Reddit? As we see, CFA wins the CPA vs CFA exam difficulty debate. Those who have taken both exams feel that being a CPA helps in CFA levels 1 and 2, but that’s about it. Then you are on your own with more study time when you think of CFA vs CPA hours.

On the CFA vs CPA salary, opinion seems to be equally divided. Many note that CFA salary levels are uncertain and almost equal to that of a CPA unless you reach the IB stage where you crack the $200,000 ceiling, so there’s not much difference between CPA vs CFA.

Here are a few snapshots from Reddit for you to judge for yourself.

These are some of the aspects covered by Reddit in CFA vs CPA.

CFA vs CPA – Which is Better for You?

There’s no magic formula to determine whether the CFA vs CPA is better for you.

Consider these points if you would want to evaluate which is better for you – CFA vs CPA:

- Which is harder CFA vs CPA: Comparing CFA vs CPA exam difficulty, not only does the CFA exam cover topics in greater depth, but it also takes more hours to prepare for. The CFA exam takes at least 2x-3x more time to prepare for than the CPA.

- CPA vs CFA salary: CFAs enjoy higher starting salaries, along with higher median and top-range earnings potential than CPAs.

- CPA vs CFA pass rate: The pass rates for the CPA exam are generally higher than the CFA.

At the end of the day, it all depends on your aptitude and interest in specific areas of accounting and finance.

- If you want to get into investment analysis, portfolio management and the like, go for the CFA.

- If you enjoy accounting, auditing, financial reporting, taxation, etc., then go with the CPA.

Bottom Line

Hopefully this article helped you understand the differences between the CFA charter and CPA license. Now, consider which credential is best for you and find out how to get started.

Interested in getting your CFA and CPA? You certainly can, but it’s not advisable right after college and may not truly be necessary. Pick one to focus on early in your career, pass the exam, and then give yourself some time to settle down in your profession. After some time and experience working, you’ll have a much clearer idea of whether you still want or need the other credential.